"If you want to invest in cryptoassets, only do it with what you are prepared to lose."

Judith Arnal, advisor to the Bank of Spain, says at the University of Navarra that "the strong rise of Bitcoin is not a sign that cryptoassets are a safe haven asset".

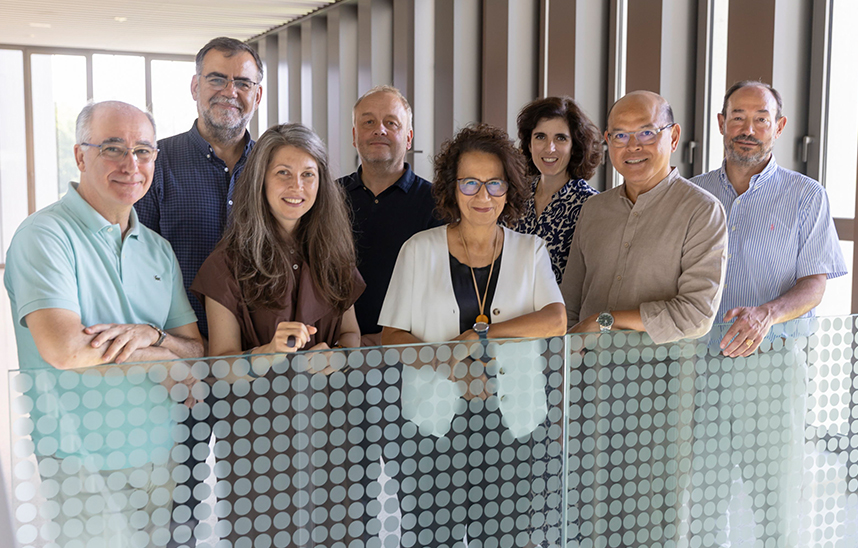

PhotoManuelCastells/From left to right, the speakers at meeting: Antonio Moreno, Full Professor of the University of Navarra; Judith Arnal, advisor to the Bank of Spain; and Claudio Tebaldi, of the University of Bocconi.

"The appreciation of Bitcoin in recent days, above 30%, is not a sign that cryptoassets are a safe haven asset." This was stated at the University of Navarra by Bank of Spain advisor Judith Arnal. In a talk organized by the Master in Economics and Finance, in addition to Arnal, a former student of the academic center, Claudio Tebaldi, from the Algorrand Fintech Lab of the University of Bocconi, and the Full Professor of the School of Economics of the University Antonio Moreno participated.

In his speech, Arnal explained that "the programs of study prove that there is an increase in public awareness about cryptoassets, but that the level of understanding about them has decreased". For this reason, he delved into the risks that exist in the cryptocurrency operating chain. Thus, he mentioned the environmental risks derived from the employment of consensus mechanisms such as proof of work, the technological risks present in the bridges between blockchain, consensus mechanisms, wallets and platforms of exchange, the financial risks derived from strong volatility or laxer governance and control mechanisms. He also referred to possible tax evasion, money laundering or other illicit activities. And he made it clear that "if you want to invest in cryptoassets, only do it with what you are prepared to lose".

Arnal also spoke of the intervention being carried out by the public sector in the regulatory field and in the exploration to introduce digital currencies from central banks. In this regard, he highlighted the approval by the Basel Banking Supervision committee of standards for capital requirements for cryptocurrency holdings by banks and stressed the importance of the possible introduction of digital currency among central banks "for reasons of financial stability, sovereignty and protection of consumers of financial services and investors". However, he assured that it is necessary to "continue to rely on financial intermediaries, set limits on holdings and discourage the use of the digital euro as a form of investment so as not to deprive commercial banks of deposits, their main funding source ".

Inflation, bubble and cryptocurrencies

For his part, the University of Navarra's Full Professor Antonio Moreno delved into the intention of cryptocurrencies to create an alternative monetary system. "They propose a system of global currencies, with payments disintermediated from commercial banks and with a record of transactions known as blockchain. They also pursue access to money and credit to people without the ability to have bank accounts, for example, in countries with few resources," he said.

In this regard, he stressed that the objectives of central banks are financial and price stability. "They fight inflation and financial panics with their tools, interest rates and loans to banks," he pointed out. Although the crypto system also pursues these objectives, he pointed out that "variable cryptos have not managed to stabilize inflation, but have created huge bubbles, and the stable ones are not exempt from problems, as was seen in the cases of Terra and Luna".

Finally, Claudio Tebaldi, from Bocconi University, highlighted the role of blockchain as a useful infrastructure to implement for the financial system, also for the traditional one. He remarked its consensus protocol to verify transactions, as well as its ability to host smart contracts that are executed based on the information present in that digital record. "To the extent that it works effectively and gains reputation, it will be able to scale in the payments infrastructure," he noted.

Finally, he established some challenges for the new digital payment system and infrastructure, such as finding a new market balance, establishing the conditions for trust and security, identifying the financial risks that may be generated, as well as finding an adequate governance and regulation. The transition to this mechanism will be smooth and "to achieve it we have the time and the money, but we need competent people with good ideas to make the system stronger, more resilient and secure," he concluded.